Did you know that funeral costs have steadily risen in the last decade? The median price of a traditional funeral in Australia is now around $19,000. And while it may be manageable for some families, it costs others their long-term plans in the present. So, what can you do to keep the costs low?

In this article, we will offer you three different solutions to your problem: You can choose to:

- invest your money in funeral bonds,

- establish your funeral insurance,

- or infuse your ashes into a Living Legacy Tree at Mornington Green

Even though thinking about death is something we want to put off, ironically the cost of inaction is far more expensive. People are using these three options to plan ahead and save their families the heavy financial and emotional burden of planning a funeral.

And although we specialise in Legacy Trees, our goal is for you to make the right decision for you and your family. So, we will do that by ensuring you have the complete picture of each funeral planning method.

We will give you the pros and cons of each one according to these considerations:

- Your current financial capability,

- The funeral’s inclusions, and

- Your preferred payment methods.

Mornington Green offers memorial services for people from all walks of life. Our position has always been to give our clients full transparency, especially in these matters. Whatever you consider for your future plans, we hope to help you through this article.

Funeral Bonds

Funeral bonds are basically like trust funds but only for funeral-related spending. Many consider funeral bonds because it basically works like a bank’s time deposit: you give your provider a lump sum or monthly instalments depending on what you want to earn at the end. You can avail of a funeral bond from a friendly society or life insurance company that you trust. When you pass away, your chosen beneficiary can take the money out, but the funds can only be used for your funeral.

How do funeral bonds work?

Funeral bonds are funds under your name that you can only use when paying for your funeral expenditures. These funds are only available if the account holder dies, so before that, funeral bonds are inaccessible.

The management company determines the terms of a funeral bond. A funeral bond typically includes a disclosure statement outlining how it works. After the funeral costs are paid, any money left over goes to your estate.

Pros:

- It is a safe and flexible way to save for your funeral expenses.

Funeral bonds are a secure, capital-guaranteed investment (meaning your investment can never be less than the amounts you have contributed). Additionally, they are governed by state and federal laws to guarantee that investments are not excessively risky. You can invest a lump sum, make ad-hoc instalments, or pay $50 a month through direct debit to contribute.

- Funds are exempt from the assets and income test.

As of July 1, 2022, contributions up to $14,000 are considered Exempt Assets for pension and aged care assessments.

- Funds can roll over.

Suppose that the funeral benefit is bigger than the cost of your funeral, the remaining amount goes to your estate.

- It encourages saving, and you gain interest, adding value to your funeral fund.

Since you can’t get the money until after you die, it encourages saving. Even if you get tempted to access your funds and use the money for other things, you won’t be able to.

Moreover, over time, your savings will keep growing. A funeral bond is an investment. Your money is professionally invested in a variety of asset classes in a way that is safe and gives you a higher rate of return than if it were just sitting in a savings account. You can get an annual bonus (return) which is not personally taxable. The accumulated dividends are credited to your policy and paid out as part of your funeral benefit.

- You can change funeral directors.

You can name a funeral director you want to work with and change that person at any time. For example, if you’ve chosen a funeral director but had to move away from that area, you can simply change it to another funeral director.

Cons:

- You only get what you’ve put and earned in the fund.

If you purchase a bond that pays out $8,000 after 10 years, but you pass away before then, your estate will only be entitled to the amount you have paid into the fund plus any investment profits generated with those funds—nothing more, nothing less.

- The returns are minimal and may not be able to cope with the current inflation rates.

Although the funeral bond fund’s investments are designed to keep up with inflation and rising funeral costs, your fund may underperform or not grow rapidly enough to match expenditures. As of June 2022, inflation rates are 6.1% in Australia. Therefore, there is a high possibility that as years go by and with continued price increases, your funeral bond won’t be able to cover your funeral costs.

- If the funeral benefit is less than the amount of your funeral costs, your family will have to pay the rest.

A funeral bond does not ensure that the cash saved and earned under the bond will be sufficient to cover all funeral expenses when the time comes. Suppose the funeral benefit your bond has accumulated does not cover the cost of the funeral, the balance will need to be made up by your family.

Funeral Insurance

Funeral insurance is a type of life insurance. You sign a contract with an insurer and agree to pay premiums for a certain amount of coverage over a certain period of time. The amount covered is usually much less than life insurance as it is designed to only cover the funeral cost rather than providing for dependents.

How does funeral insurance work?

You pay premiums (ongoing payments) every month or every two weeks for a fixed amount of coverage. Most of the time, you can choose between $5,000 and $15,000 in coverage, which will be given to your family when you die.

Funeral insurance is not a way to save money for funeral costs. You buy insurance to pay for these costs at some point in the future.

When you die, a funeral insurance policy gives your family a lump sum payment that they can use to pay for your funeral costs.

Pros:

- You’re immediately covered

Funeral insurance works exactly like how insurance would. Once you avail it, you’re immediately covered for the total insured amount. Only accidental death is covered in the first 1–2 years of the policy. This means, for example, that if you die after 3 years, your payout could be more than the amount of the premiums you’ve paid up to that point.

- The beneficiaries can use the lump sum to take care of a wide range of immediate expenses

Depending on your insurer, you can receive a minimum of $5,000 and a maximum of $15,000. Premiums are based on your circumstances to ensure that you are adequately covered.

- You can quickly claim it

It is paid out immediately, within 3 to 7 days, when you place your claim. This means you don’t have to stress about how you will pay for expenses. Your beneficiaries will just need to provide proof of a certified death certificate to the insurer.

- Smaller payments than prepaid funerals

Funeral insurance premiums require a much smaller monthly payment than prepaid funerals, which must be paid for all at once or in instalments over a few years. If you get one early, you’re also at an advantage because your premiums will likely be lower than average.

- It can be preferable to a particular demographic

People with numerous health problems and seniors who can’t get life insurance because of age limits may benefit from funeral insurance.

Cons:

- There are no refunds, and there are exclusions.

Like all insurance policies, if you lapse in payments or voluntarily withdraw at any time, you lose all the money you have paid in premiums until that point. There would be no refunds. Exclusions also apply in the first few years. For example, you may not be covered if you die of a fatal illness or suicide. Only accidental death is covered in the first 1-2 years of the policy. That’s why it’s important to check the terms and conditions of your policy.

- It can cost you more than the death benefit and actual funeral costs.

Each plan has a specific fixed payout (regardless of whether funeral costs have risen). You have to keep paying until death, so if you get one early and live a long life, the premiums you pay could add up to much more than your actual funeral costs.

- Premiums will increase over time.

Over 10 to 15 years, premiums can sometimes triple, making it impossible for many people with a fixed income, like a government pension, to pay for a policy. Since you can’t get your money back if you cancel a policy, buying funeral insurance can be a very expensive mistake.

Mornington Green

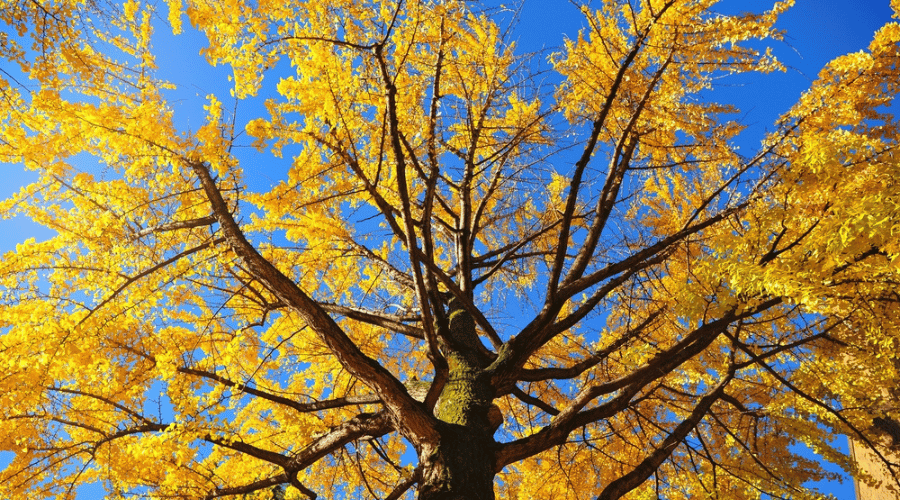

How about skipping traditional methods and becoming a living memory when you die? Let your ashes live on trees with Mornington Green.

What is Mornington Green?

At Mornington Green, your ashes are given a scientific treatment that turns them into living molecules. They are infused with a beautiful tree of your choice in a quiet forest, where your loved ones can visit you all year and see your tree grow.

A conservation agreement protects your tree, so the land it is on can’t be built on or cut down. Each tree also gets a plaque made just for you and will always be there.

Pros:

- It’s an eco-friendly option.

Living Legacy has perfected a way to turn ash into living molecules so that a person’s energy can live on through trees. So when you choose the Mornington Green way, you’re choosing to live as part of nature again. Moreover, when you plant a tree with us, you join a growing group of people making new forests and homes for endangered animals like the mainland Quokka and Black Cockatoo. Lastly, for every founder’s package bought, Mornington Green offers 400 extra trees to be planted in honour of the person.

- It revolutionises the way we think of “cemeteries”.

From the moment you enter Mornington Green’s beautiful and lush gardens, it’s as if you’re transported to a green paradise. Mornington Green offers a high-quality experience that tries to change how we think about memorials by connecting people to the beauty of nature that their lives make. This beautiful site on the Mornington Peninsula was carefully chosen for its excellent conditions, landscapes, and distance from fire zones.

- Costs are upfront and fixed regardless of the inflation rate.

The costs are upfront from $7,000 + GST, which is more than half of the average price of traditional methods. You also don’t have to worry about the inflation rate affecting your funeral costs in the future. At Mornington Green, you can prepare for your funeral at today’s price and not at what it will cost in the future.

- It is cheaper than a traditional burial.

It is cheaper because you don’t have to buy all the add-ons that come with traditional burials. Usually, the extra funeral funds from families can be used for the ceremony or other practical uses.

- It is highly rated.

It is the first botanical memorial garden whose only goal is to grow Living Legacy Trees. Mornington Green is proud to offer the Australian Government’s best practice standard for cremated ash, which is used all over the country. Industry leaders like the Greater Metropolitan Cemeteries Trust (GMCT), Northern Cemeteries in NSW, the City of Brisbane, Tobin Brothers, and Chapter House use Living Legacy as the best practice standard for sustainable memorials.

Furthermore, Mornington Green maintain 4.9 stars on Google reviews.

Cons:

- It is not for everyone.

For example, some denominations of other religions have cremation out of the picture because it’s incompatible with their customs. Some families still see traditional burials as the “normal” way of sending a loved one off. A permanent burial spot can also be more sacred for others. This means that cremation may be out of the picture.

- Mornington Green’s Botanical Garden is only located in Victoria.

If your loved ones are in another state, they may not be able to visit you or join in on community events. Or if you suddenly move to another place, it will be difficult to arrange your funeral once you pass away.

- Direct cremation is still the cheapest option.

If you’re tight on money and are looking for the cheapest alternative to traditional burial, direct cremation is still the option to go for.

WATCH: What is the difference between Mornington Green and a traditional burial?

In conclusion…

Now that you’re aware of all three choices for financing funerals, check out this table that summarises the pros and cons of all:

| Financial Plan / Method | Pros: | Cons: |

| Funeral Bonds | – Safe and flexible – Exempt from from the assets and income test – Can roll over – Encourages saving and you gain interest – Change funeral directors quickly |

– You only get what you’re entitled to – Interest may not be enough to cover inflation – Not guaranteed to cover entire funeral costs. |

| Funeral Insurance | – Immediate coverage – Beneficiaries get a lump sum – Quick claim – Smaller payments than prepaid funerals more preferable to a certain demographic. |

– There are no refunds and there are exclusions. – Can be more expensive in the long run with continued premiums than actual funeral costs – Premiums will increase over time. |

| Living Legacy Trees / Non-traditional methods | – Eco-friendly – Revolutionises “cemeteries” – Costs are upfront and fixed regardless of the inflation rate – It is cheaper than traditional burial – It is highly-rated |

– It is not for everyone – Only located in Victoria – Direct cremation is still the cheapest option. |

Each of these offerings has pros and cons. As you can see, as long as you know your financial capabilities and preferences, you can definitely land on the best decision for you and your loved ones as you pass away. Our article has hopefully helped you in one way or another in deciding when the inevitable happens.

We hope this has helped. If you have any more questions, feel free to contact us via our contact page or call us today at (03) 9059 4959 to learn more.